Digital Journey Series: Digital Strategy

A critical step companies take to ensure success nowadays is to align their corporate business strategy with a digital strategy. Follow along as we cover the primary components of a digital strategy and how organizations are measuring progress in terms of achieving their goals.

1. Emergence of Digital Strategy

Until very recently, developing a standalone digital strategy is something that was uncommon. However, as companies began to understand the need for embarking on a digital transformation; the practice of creating a digital strategy began to build steam. But while companies understand the need for a digital strategy, not all are well-versed in how to develop and execute one. A common problem many companies have is distinguishing between a digital strategy and a technology plan. A technology plan deals with hardware, software, networks, and overall technological architecture. But a digital strategy is fundamentally different. A digital strategy is about changing the nature of a company by influencing the way it thinks about and invests in new technology. Therefore, a digital strategy needs to align with the overall corporate strategy, so that it can successfully address all aspects of the business lifecycle.

Lifecycle Business Intelligence

While technology is obviously an important aspect of a digital strategy, the foundation of a successful digital strategy focuses more on data. More specifically, a digital strategy is about the vision and goals for the collection, management, and analysis of data along with the supporting technology and organization to derive business intelligence from this data.

2. Energy Data Platform

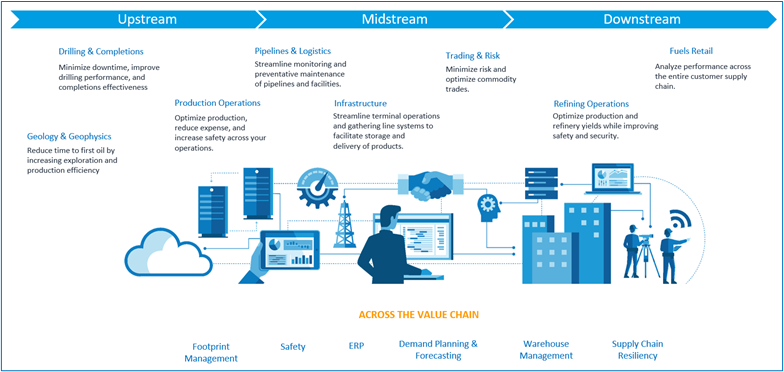

In a previous blog, The Energy Data Platform, we discussed the need for an enterprise strategy for delivering the most up-to-date and accurate data to the business for decision making and reporting.

The Energy Data Platform

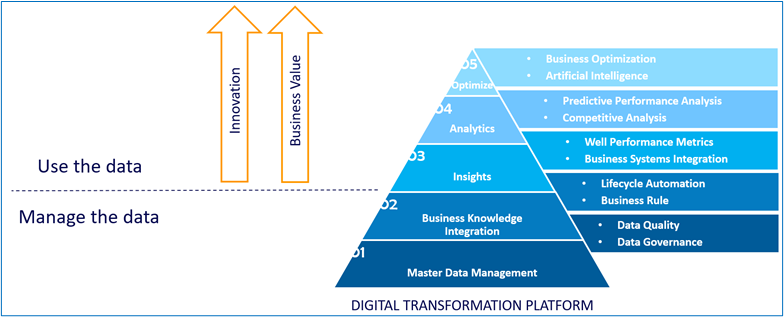

As we covered in The Energy Data Platform, it is important to build a strong foundation based on the Master Data Management, and then use this data to capture knowledge of the organization. The problem with this approach is that most companies want to dive straight into the cool stuff and end up loading loads of data into a data lake, expecting that analytics tools will make sense of things. This usually ends up failing and these same companies end up starting their efforts over again. In a 2019 article, Forbes stated that one of the primary reasons that over 70% of digital initiatives fail to deliver their expected value is due to the lack of a system of record (SOR).

From a strategic perspective, we need to consider the difference between using data and managing data as we can see in the diagram. Historically, experienced employees spend most of their time looking for data and then validating it, and maybe even cleaning it up before they can focus on the actual value-add part of their job. The successful companies will be the those who are able to switch this dynamic so that valuable knowledge workers spend the majority of their time using data.

But this will require that processes associated with gathering, validating, blending, and consuming data need to be automated for practicality. Industry initiatives such as the OSDU, which cloud service providers implement can deliver strategic functionality which we will discuss in more detail later.

3. Technology

Technology is advancing at an incredible pace with some of the most successful companies understanding how and where to use technology to gain a competitive advantage. While technology is not entirely what a digital transformation is all about, having a well-defined technology roadmap is still a critical component of any digital strategy.

Here at Quorum, we conducted an 18-month long survey to understand where the industry is heading from a technology perspective. What we found is that the industry is trailing behind other industries in the adoption of several technological key priorities, namely: cloud, mobile, IoT, and analytics.

Cloud

In today’s volatile energy industry, the need for cost-saving efficiencies and immediate access to information and insight has never been greater. Benefits include:

- Lowering IT infrastructure costs: Companies that use cloud technology achieve workplace efficiencies and avoid interruption via faster deployment and easier ongoing support.

- Scaling operations as needed: Because cloud applications share resources, scaling based on fluctuating market conditions is far more economical and swifter.

- Breaking down operational silos: Cloud applications enable company-wide collaboration by providing cross-department access to centralized information to help users make informed decisions.

- Future-proofing software investments: Cloud applications are easier to extend by adding new functionality and interoperating with additional resources.

- Driving innovation: applications can be developed and deployed much faster using common web services to handle foundational tasks.

Mobile

The need for mobile access to information and business processes is pushing mobile technology across the value chain to improve decisions and collaboration. Benefits include:

- Improved decision making: The reliability of data captured on mobile, combined with the ability to immediately store, share and act on that information improves decision making.

- Workforce collaboration: Mobile enhances collaboration between field and back-office personnel and enables managers to accelerate approvals and workflows.

IOT

The cloud and smart devices are blurring the lines of where the back office ends, and the field begins. As Oil & Gas pushes intelligence to the edge, optimization and cost controls are increasing and driving new revenue opportunities. Benefits include:

- Lower maintenance costs: Access to device, well and meter telemetry will help companies predict downtime and control maintenance costs and needs proactively.

- Field data in real time: Pushing data from smart devices in the field into the back office means decisions don’t get stale shortly after they’re made.

- Optimizing assets: In addition to lowering maintenance costs, remote monitoring helps technicians and engineers tune assets to operate more efficiently.

- Reducing risk: Automating data capture improves the accuracy and timeliness of field information that feeds business processes and ongoing operations

Analytics

Data analytics has been the primary Digital Transformation investment area for most organizations over the last five years. The focus has been on putting decision making back in the hands of the users.

Significant success has been achieved with this approach resulting in a measurable impact to the financial bottom line of business and in other areas including HSE (Health, Safety, and Environment). Analytics programs have been primarily driven by individual business units or IT departments and not at the enterprise level. As a result, the focus of the analytics depends upon who you are talking to within the organization:

- Subsurface is primarily concerned with competitive analysis to understand how best to develop an asset or to determine which area to move into.

- Drilling and Engineering is primarily concerned with descriptive analysis to evaluate drilling and completions performance.

- Operations are looking at predictive analytics to identify potential failures and performance drop off.

Up to this point, initiatives have tended to be backwards looking in the form of diagnostic, or descriptive analysis. Companies analyze huge quantities of information to look for new opportunities or to improve operational performance. More recently, there has been increased investment in forward-looking predictive and prescriptive analytics that are tied to artificial intelligence and machine learning. This is typically focused on predicting equipment failure or evaluating potential performance based upon scenario evaluation.

The survey also revealed that digital strategy is heavily influenced by the size of the organization. Large companies typically undertake enterprise level initiatives with ambitious goals for driving the digital transformation. Smaller companies are typically focused on smaller incremental changes to automate routine tasks. Taken individually they have a minimal impact but in combination they can have a dramatic effect on business performance. Essentially it becomes a strategic choice between digital transformation and a focus on operational excellence.

4. Organization

Digitalization requires trying new things by its nature, and that means taking risks and being innovative. Cultural change is critical, and the greatest gains are made when working to push past natural resistance to risk-taking in the middle layers of management. Senior executives need to be involved in envisioning how the next wave of digital can lead to performance breakthroughs.

What’s likely is that favorable markets will return before the Digital Transformation, with a shortage of good people available during transition. Most oil and gas companies are not taking advantage of digital to resolve workforce issues either, and this means cost pressures and staff reductions are resulting in achieving more with less. 60% report having lost critical staff over the past 2 years, with another 50% saying that a beneficial impact of digital is boosting productivity of employees that remain.

With regard to workforce, digital is being used to upskill workers and to leverage contingent labor. Most companies think they are 3.5 years away from having a solid base of digital skills, with the hope that digital will enable workers to focus on higher value activities instead of repetitive tasks.

“Efforts to date have been evolutionary. Companies achieve greater benefit by pursuing a revolutionary strategy with a digital backbone. A digital transformation strategy needs support from C-level and significant investment.” World Economic Forum (WEF)

Some companies have created enterprise groups entirely dedicated to analytics and managing emerging technology, and often they have achieved great success with these efforts. Other companies have left responsibility with the business units or IT, an approach which we think is less effective. One other observation we have made which seems obviously ineffective is the practice of hiring a group of data scientists and expecting great results without matching them with domain experts. The last thing you want to do is pay somebody $300k a year to try to figure out the difference between allocated and unallocated production to locate optimal treatment data.

What often gets overlooked in the rush to analytics, is where responsibility for Well Lifecycle data management resides. Again, in our opinion, the most successful companies are the ones that identify this as a specific function separate from IT as well as analytics with responsibility for governance over all the business units. People in these teams should have training and career paths just as any geoscientist or petroleum engineer would; it is just as important a function to business success.

5. Signposts along the Journey

We have covered a broad range of topics so far in this series around a core theme of effective data management in a rapidly changing industry. The pace of change and the scope of the challenge is overwhelming to some companies to the extent that they are either frozen in place or are diving into a specific area, typically analytics, to at least give the impression of progress.

A recent study by Gartner found that almost 90% of organizations have low business intelligence and analytics maturity. For organizations wanting to optimize the value of their data or exploit emerging analytical technologies such as AI or machine learning, this is a rather big obstacle to overcome. Other companies are embracing the Digital Transformation and are beginning to realize significant benefits, and these are the companies that will go on to become industry leaders 3 years from now.

Based upon observations over the last few years, we will attempt to lay out a path for a digital strategy that could at least be used as a framework by those oil and gas companies committed to a Digital Transformation.

We start with the first step, which is always the toughest for everyone starting something new: lacing up your running shoes. In this case, we look at whether your organization is more interested in a digital transformation or focusing on operational excellence. They are not the same thing, and you will need to understand what the goals of the business are before you embark upon the outlining of a Digital Strategy.

Taking the first step

That question is about what kind of approach do you want to take? Yes, digital technologies may enable or disrupt many business models, but the technology is a secondary factor not the primary motivation. So here are the definitions of two different paths for your digital journey that we believe you must answer first. Are you wanting to achieve Digital Transformation or Operational Excellence?

Digital transformation

Is about moving towards a new business model, based upon leveraging the information intensity of the digital oilfield. This changes WHAT you do. Some examples in other industries are Uber, Lyft, AirBNB, Amazon, Spotify, Travelocity, Trivago (and maybe as-a-service companies like WellAware and GE Digital).

Operational Excellence

(OE) programs improve asset performance (either by lowering operating expense, improving health, environment, and safety, increasing production, lowering capital expense, or fixing some specific functional workflows). OE is based on improved decision making, enabled by information intensity of your operations or your supply chain (VOLUME & VARIETY), greater connectivity (VELOCITY), and advanced analytics of the digital oilfield (simulation through a Digital Twin or by remote operations decision centers and “manage by exception” business processes). This changes HOW you do your current business and operational practices but not fundamentally what business you are in.

Once you answer the question about digital transformation or organizational excellence in your corporate business strategy and start aligning your organization metrics, management rewards structure, investment strategy,; then the authors are OK if you want to develop a Digital Strategy.

Organizational Innovation

It is a common refrain that any successful enterprise initiative requires support from the very top of the organization all the way down through the various levels of management. This is especially true with a Digital Transformation that will impact all areas of the organization and will typically meet resistance from many quarters.

Where we have seen companies be successful is where the CEO has made digital technology a clearly stated priority and it becomes part of the performance measurement criteria of the senior leadership team. Without this level of support, or where senior executives are paying lip service to the concept, it is evident that very little progress will be made towards implementing an enterprise strategy since individual business units will follow their own path.

Establishing a culture of innovation and technology adoption is not easy, particularly for larger more established companies. However, a key component of any successful digital strategy is to be willing to try new things and accept failure. While not everything will work out, you will always learn something and the benefits of the initiatives that do work will far outweigh minor setbacks. The key is to recognize very quickly that something is not working and be willing to pivot quickly.

Several companies that we interviewed have established a separate group to focus on emerging technology and how it can be applied within the organization. The key to creating these groups, however, is to maintain a balance between digital and domain expertise. In our opinion, promoting from within as much as possible provides opportunity and retains corporate knowledge.

Not doing so results in a similar example to one company which embarked on a digital strategy and hired a significant number of data scientists from outside the industry at great expense with the goal of developing an advanced analytics program. The lack of domain knowledge on the underpinnings of a Well master data management solution was a major hindrance and one year later, little business value had been realized.

As a final observation, companies often confuse innovation with the application of new technology. That might be because they are often chasing and promoting the latest tool that will provide a silver bullet solution to the data management problems of the organization. The reality is that innovation is about solving business problems in new ways either through the application of new technology, new processes and algorithms, or some combination thereof.

Building the Platform

It’s strange having to emphasize that having a Well master data management solution containing a single source of the truth should be a fundamental requirement for any company operating in the oil and gas industry. But the surprising problem is that several organizations ranging from the smallest all the way to super majors either don’t have a consolidated Well master or try to manage data within applications that are not designed for that purpose.

As we discussed earlier, an MDM solution is the foundation for a successful digital transformation and should be one of the opening gambits within a well-formed digital strategy.

In turn, one of the key components of a well-formed MDM platform is effective data governance that establishes the key definitions, business rules, and best practices by which data will be managed. Many companies either do not establish a strong governance practice or swing to the other end of the spectrum and spend all their time and money on elaborate governance hierarchies that cannot be practically implemented.

The reality is that enormous amounts of work have been completed over many years around data governance that is widely available. Organizations such as PPPDM and Energistics have published tremendous work on a wide variety of topics and this should always be used as a starting point.

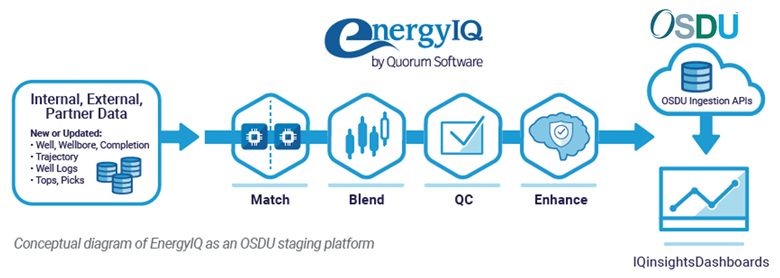

Looking to the future, the OSDU initiative illustrates the way that the industry is headed even though it is likely to take some time to get there. The OSDU provides a consistent, cloud-based methodology for managing and accessing oil and gas data. There are standard APIs for ingesting and consuming data so that applications that interface with the data through these APIs do not need to be concerned with how the data is stored in the background eliminating many of the problems that have plagued the industry over the years. The ultimate goal of this approach is for operators to be able to maintain a single source of trusted data in a central location that is used by the enterprise. Furthermore, future web applications will interface directly with this data avoiding the need to maintain a separate copy with the associated transfer issues.

It is important to note, however, that the OSDU does not provide all of the functionality of an MDM solution including matching, blending, aggregation, validation, and identification. This may be incorporated with time but in the meantime (probably a long time), MDM solutions such as Quorum’s TDM have an important role to play in the ingestion process as illustrated in the workflow diagram below.

Measuring Maturity

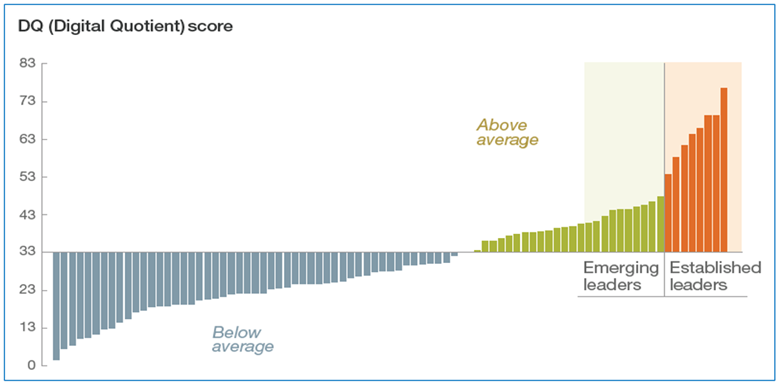

Companies are beginning to assess their progress along their digital transition journey by measuring their digital maturity. It is no surprise that the companies that rate highly in these measurements are significantly outperforming their competition and are best suited to deal with the energy transition underway.

Consulting firms such as McKinsey and the Boston Consulting Group have developed methodologies for measuring the Digital Quotient as illustrated in the diagram. This is important for measuring progress throughout the implementation of the digital strategy as well as enabling organizations to assess performance against their peers.

Digital Maturity: McKinsey Group