5 Ways Upstream On Demand Transforms Oil & Gas Accounting

When complicated operations, high-stakes investments, and daunting regulatory requirements gather at your door, it’s time to check in with your current accounting systems. A basic spreadsheet isn’t designed for the advanced requirements of efficient, error-free resource allocation, risk management, and compliance. But streamlining oil and gas accounting can be simple. Well-informed decisions, a clear understanding of heavy datasets, seamless collaboration capabilities, and real-time insights usually come with a great software solution. Learn more about Quorum’s true multitenant SaaS solution, On Demand Accounting from Quorum’s Product Expert Kevin McArthur in this video demonstration.

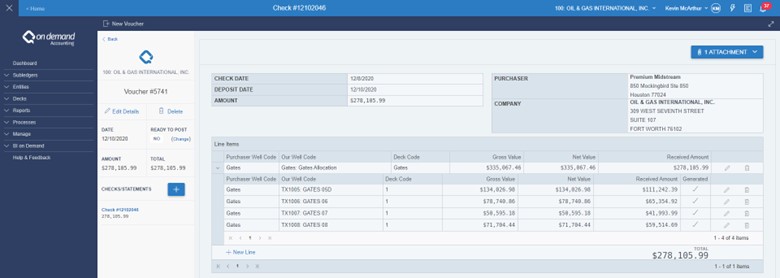

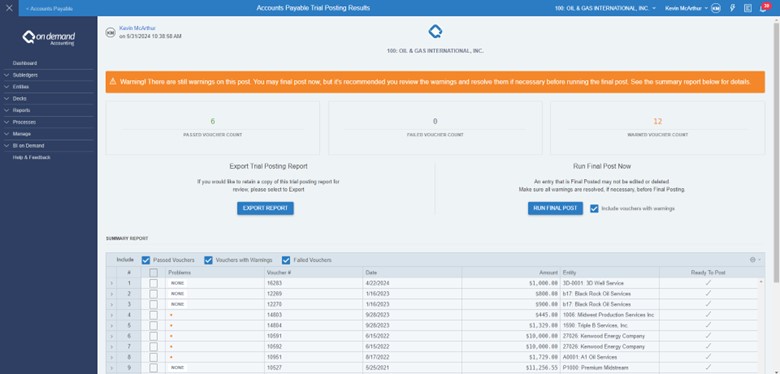

On Demand Accounting enables users uploading revenues across multiple wells and receive immediate feedback around any warnings or errors included in a template. The video shows how if a file doesn’t have errors and the user accepts all warnings, they can continue the import which will take the data from the staging area and automatically generate revenue vouchers.

With the data loaded, a user can focus on more important items like making sure owners are getting paid on time versus worrying about manually inputting the data.

What is Oil and Gas Accounting?

As an area of accounting expertise, oil and gas accounting monitors and records financial transactions within the oil and gas domain. It guarantees clear financial disclosures and compliance with regulatory requirements. The resulting strategic decision-making is born of weighing the worth of a company’s assets’, mitigating risks, and balancing across exploration, extraction, and production activities.

The Limitations of Traditional Upstream Accounting Practices

Basic spreadsheets and conventional software serve only basic needs, its common that accountants find themselves spending too much time performing off-system processes such as expense and revenue allocations as well as manual data entry which ultimately increases the risk for data entry errors and can also lead to longer close cycles. Operators on each step of the value chain dealing with the industry have a need for greater collaboration, data accessibility, automations, and real-time data analysis.

Oil and Gas Accounting Tips: The Need for Specialized Solutions

Purpose-built accounting solutions within the oil and gas industry fit unique financial and operational challenges such as regulatory compliance, fluctuating market prices, and a high volume of transactions. With On Demand Accounting, ensure accurate billings and royalty distributions, reduce manual entry of invoices, revenues, and journal entries saving accountants hours each day. Operators who are ready to join the future and reallocate important resources can find the next generation accounting software in Quorum’s suite of Upstream On Demand solutions to drive success at their company.

Simplifying Upstream Oil and Gas Accounting

Consider these five steps in making life easier for oil and gas accounting.

Step 1: Managing Well Interests

Proper management of well interests with the right solution can streamline processes with the accuracy needed in fine-tuning ownership stakes and other vital records. These include documentation of lease agreements, ownership percentages, revenue distributions, and expenses related to the operation of the well.

Step 2: Recording and Distributing Revenues

Revenue distribution is no simple process. Automation reduces errors and saves time, ensuring fairness and transparency. Think of all involved like various stakeholders, contractual agreements, market dynamics, regulatory considerations—the list goes on.

- Joint Ventures and Partnerships

- Production Sharing Contracts (PSCs)

- Royalties, Marketing Deductions and Exemptions

- Price Volatility

- Revenue Netting Against Open Receivables

- Check Stub Detail Requirements

- Contractual Disputes and Arbitration

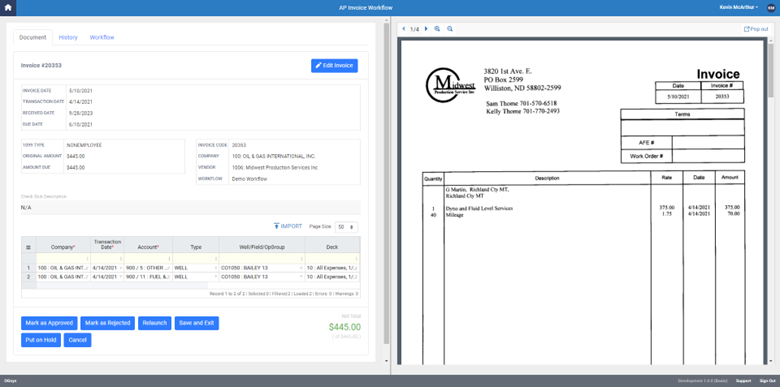

Step 3: Routing Invoices with New AP Workflow

Quorum’s new Accounts Payable (AP) workflow has an undeniable impact on invoice management through intuitive cost-saving automations as routing, approval, and payment processes are all streamlined.

Step 4: Simplifying Joint Interest Billing (JIB)

From share ownership interests in wells, leases, or production facilities, more simplified Joint Interest Billing (JIB), allows for greater detail of expenses and transparency in collaboration for working interest owners to explore, develop, and produce hydrocarbon reserves.

It more rapidly allocates costs associated with exploration, drilling, production, and maintenance activities proportionally among the working interest owners based on their ownership interests.

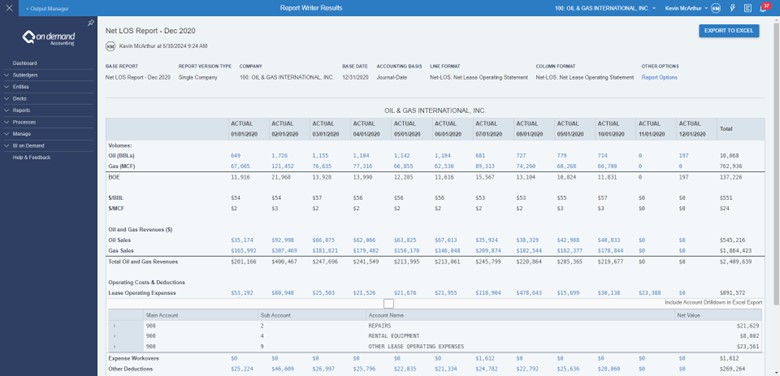

Step 5: Reporting and On Demand Data Hub

Flexible reporting options like the built-in Report Writer as well as Business Intelligence (BI) with On Demand Data Hub offers real-time insights from critical business data and analytics, enabling informed and timely decisions based on up-to-date information. Data visualization makes complex data sets easier to interpret, identifying opportunities, mitigate risks, and optimize business strategies for better forecasting, and strategic planning.

Implementing the Solution: Steps to Success

With a step-by-step approach to adopt any solution, initial training familiarizes all users with the platform. It is followed up by thorough data migration and seamless transferal of all existing information then integrated within existing systems to maintain workflow continuity. Finally comprehensive user adoption strategies ensure the solution's full utilization and effectiveness.

The Role of Expert Guidance

A high level of expertise during transitional times untangles the complexity of all involved systems. It fulfills the need for accuracy in data migration, compliance with regulatory standards, efficient workflow management, and customization to meet specific business requirements. With repeated, multi-phased demonstrations by product experts like Kevin McArthur, valuable insights can ensure a smooth implementation.

The potential impact of adopting an accounting solution befitting the demands of the oil and gas industry is all about increasing the efficiency and profitability of an operation. What strategic investments are you ready to make to upgrade your accounting system?

For more, check out a brief practical demonstration of On Demand Accounting.